If a Will is the most important document in Estate Planning, having a properly drafted Financial Power Of Attorney is a close second.

A Financial Power of Attorney (POA) document is crucial in Lancaster, Pennsylvania because it allows you to designate someone (called an "agent") to manage your financial affairs if you become unable to do so. Your agent can pay bills, manage investments, handle real estate transactions, and more. Typically, you would also designate a substitute agent in the event your first choice predeceases you or is otherwise unable to act. While the document takes effect as soon as it's signed and fully executed, it is intended to be durable, or withstand any incapacitation. Without a POA, if you become incapacitated, your family may need to go through a lengthy and costly court process to appoint a guardian to manage your financial affairs. A POA can prevent this by giving your agent immediate authority to act on your behalf.

By carefully choosing a trusted agent and including safeguards in the POA, you can protect yourself against financial abuse. Pennsylvania law also requires agents to act in your best interests, providing an additional layer of protection. Knowing that your financial matters will be handled according to your wishes if you’re unable to manage them provides peace of mind for both you and your loved ones.

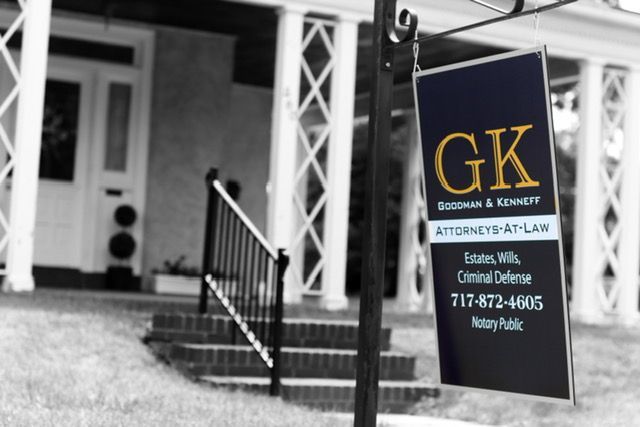

Because we understand the importance of having your estate affairs in order, and because, in Pennsylvania, a POA is relatively easy to execute, we always keep our estate planning documents at our Millersville, PA office reasonably priced.